Is Greed Still Good?

"Greed, for lack of a better word, is good," stated Gordon Gekko in the 1987 blockbuster film Wall Street. Gekko, the bad-guy, corporate raider further asserted that greed is not only necessary but that it “captures the essence of the evolutionary spirit.”

In his striped suspenders and contrast collar — Gekko, played by Michael Douglas, became a symbol of power and excess in the audacious 80’s — a decade of trickle-down economics, materialistic yuppies, and high-flying financial markets. It was a time of euphoric bulls, madcap spending, and massive accumulations of personal wealth.

Greed was synonymous with influence and success which was exceedingly attractive to young boomers, novice industrialists and tycoons in-training — and that was “good” — at least for the moment.

In the Fed’s Finance and Economics Discussion Series called, ‘A Brief History of the 1987 Stock Market Crash with a Discussion of the Federal Reserve Response,’ Mark Carlson, Board of Governors of the Federal Reserve described market conditions like this:

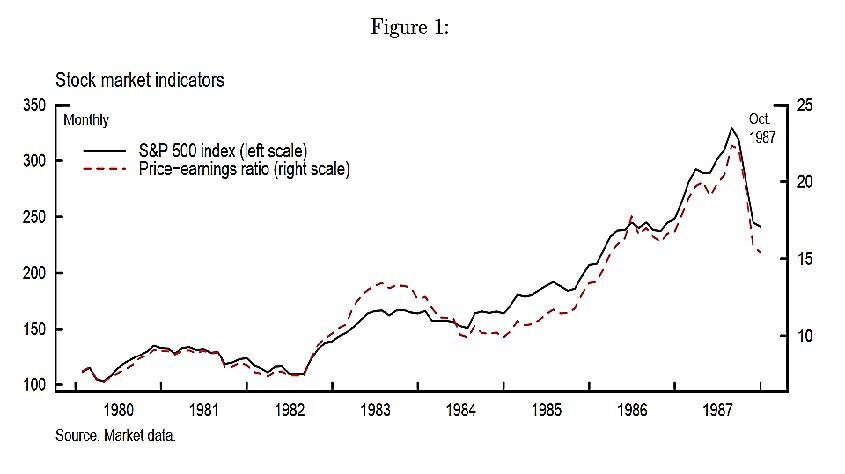

“Equity markets had been posting strong gains. Price increases outpaced earnings growth and lifted price-earnings ratios; some commentators warned that the market had become overvalued. There had been an influx of new investors, such as pension funds, into the stock market during the 1980s, and the increased demand helped support prices. Equities were also boosted by some favorable tax treatments given to the financing of corporate buyouts, such as allowing firms to deduct interest expenses associated with debt issued during a buyout, which increased the number of companies that were potential takeover targets and pushed up their stock prices.”

But on October 19, 1987, everything changed as Wall Street suffered a sudden and systematic collapse. The Dow saw its biggest one-day percentage loss in history in a selloff that reverberated around the world. It was a chaotic frenzy of overloads, meltdowns and margin calls, and a day of reckoning for all those that lived large and invested larger.

We quickly learned that neither Lynch, Buffet, Bogle nor Gekko were invincible — and that all markets are inherently volatile and paper assets carry intrinsic risk. While greed drove the index to dizzying and irrational heights, fear pulled it down to catastrophic and sobering lows. The closing bell was the trumpet of doom for all those that got burned by the day’s rapid and relentless loss of wealth.

The following morning, The New York Times headline blared, “Stocks Plunge 508 points, A Drop of 22.6%; 604 Million Volume Nearly Doubles Record.”

To understand the depths of the collapse — consider that the worst one-day drop during the market crash of 1929, was just slightly over 12%. Black Monday exposed glaring issues about market overvaluation and speculation as well as the impact of automatic trading and algorithmic buy and sell models. 1987 was a risk-on environment of mergers, acquisitions and hostile takeovers within a shifting landscape of social, political and economic events. And the lessons of the crash underscore the notion that markets do not rise indefinitely and that financial context matters greatly.

The post-bear market breakout was ultimately brought to its knees by foreign trade agreements, dollar depreciation, geopolitical tensions, and a bull market that was long overdue for a steep correction. Despite a sustained rise in share prices, prolonged hot streaks, and recurring market milestones — $1.7 trillion vaporized a single, dismal day.

This, of course, sent depositors rushing to hard assets or those investment strategies that offer the greatest return with the least amount of risk. Hard assets help to preserve wealth and safeguard savings by diversifying financial holdings.

Real estate, in particular, allows investors to fully leverage capital, exploit tax benefits, generate steady income and enjoy substantial appreciation. Perhaps the best part about investing in real estate is that you can see it, drone it, and drive past it. More importantly, it won’t evaporate in a single afternoon or vaporize in a flash crash or robot trade.

The ultimate lesson of Black Monday is more than a cautionary tale about putting all of our eggs in one basket. It’s a warning about whether to hold any ‘eggs’ at all — particularly right now. Unlike twitchy markets, real estate does not crack on every earnings report or break on routine fluctuations in sentiment.

Gordon Gekko perhaps accurately asserted that greed in all of its forms “has marked the upward surge of mankind." But he neglected to point out that it has also, tracked the downward trajectory of every major monetary crisis in history. So, we must prepare accordingly.

To find out more about the best hard assets of 2020, click here.